Learn how you can use capital losses to offset capital gains. In other words it is accounted for on an accrual basis not a cash basis.

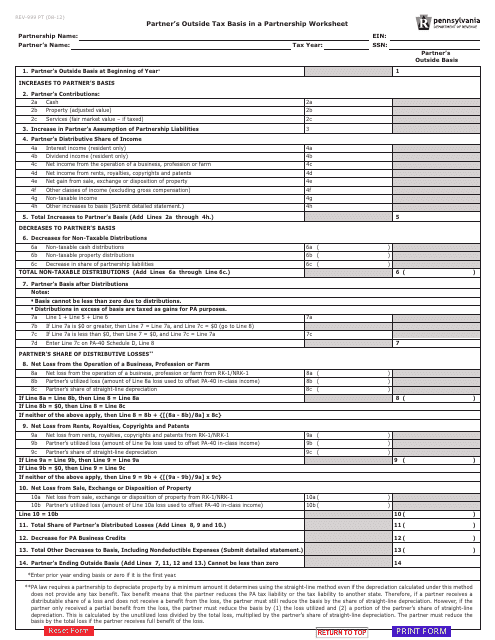

Form Rev 999 Download Fillable Pdf Or Fill Online Partner S Outside Tax Basis In A Partnership Worksheet Pennsylvania Templateroller

On a quarterly basis.

. A lease agreement must explicitly list the monthly rental amount and outline what the consequences are if the rent is late. For those employers who have applied for the subsidy as soon as this could be done this shouldnt cause problems. If the shareholder fails to include Tax Exempt Interest in the calculation then the Tax Exempt Interest will be taxed when the stock is sold even though it shouldnt be taxed.

If you sold your assets for more than you paid you have a capital gain. If you refigure an item for AMT by completing an AMT version of a form or worksheet keep a copy of that AMT form or worksheet for your records. It continues on a per month basis until either the landlord or tenant terminates the agreement.

A Kind of property and description b Date aquired. Set how much rent is owed. Tax Exempt Interest increases shareholder basis.

Find your filing status and your. The qualifying periods in 2020 end on April 11 May 9 June 6 July 4 August 1 August 29 September 26 October 24 November 21 and December 19 2020. Carrybacks carryforwards basis amounts depreciation and loss limitation amounts that differ between the AMT and the regular tax.

Solely for purposes of calculating a loss on the sale of the stock of a specified 10-owned foreign corporation if a corporate shareholder received an actual or constructive dividend after December 31 2017 and that dividend qualified for the 100 dividends-received deduction the shareholder must reduce its basis in the controlled foreign corporation stock in the amount of. An example of the Term section from our printable lease agreement. Names as shown on Form NJ-1040NR Your Social Security Number PART I Net Gains or Income From List the net gains or income less net loss derived from the sale exchange or other Disposition of Property disposition of property including real or personal whether tangible or intangible.

Non-dividend distributions reduce stock basis while dividend. Other credits Worksheet line 14 If you will be eligible to claim any credits other than the credits listed in the worksheet such as an investment tax credit you may claim additional allowances. Basis is increased by this amount to preserve the nature of the Tax Exempt income.

If you sold your assets for less than you paid you have a capital loss. For more information see the instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals or see Need help. Review the list below to know which tax rate to apply to your.

Subtract your basis what you paid from the realized amount how much you sold it for to determine the difference. Partners and Shareholders If you are a partner in a partnership or a.

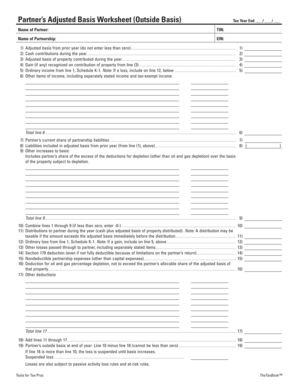

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

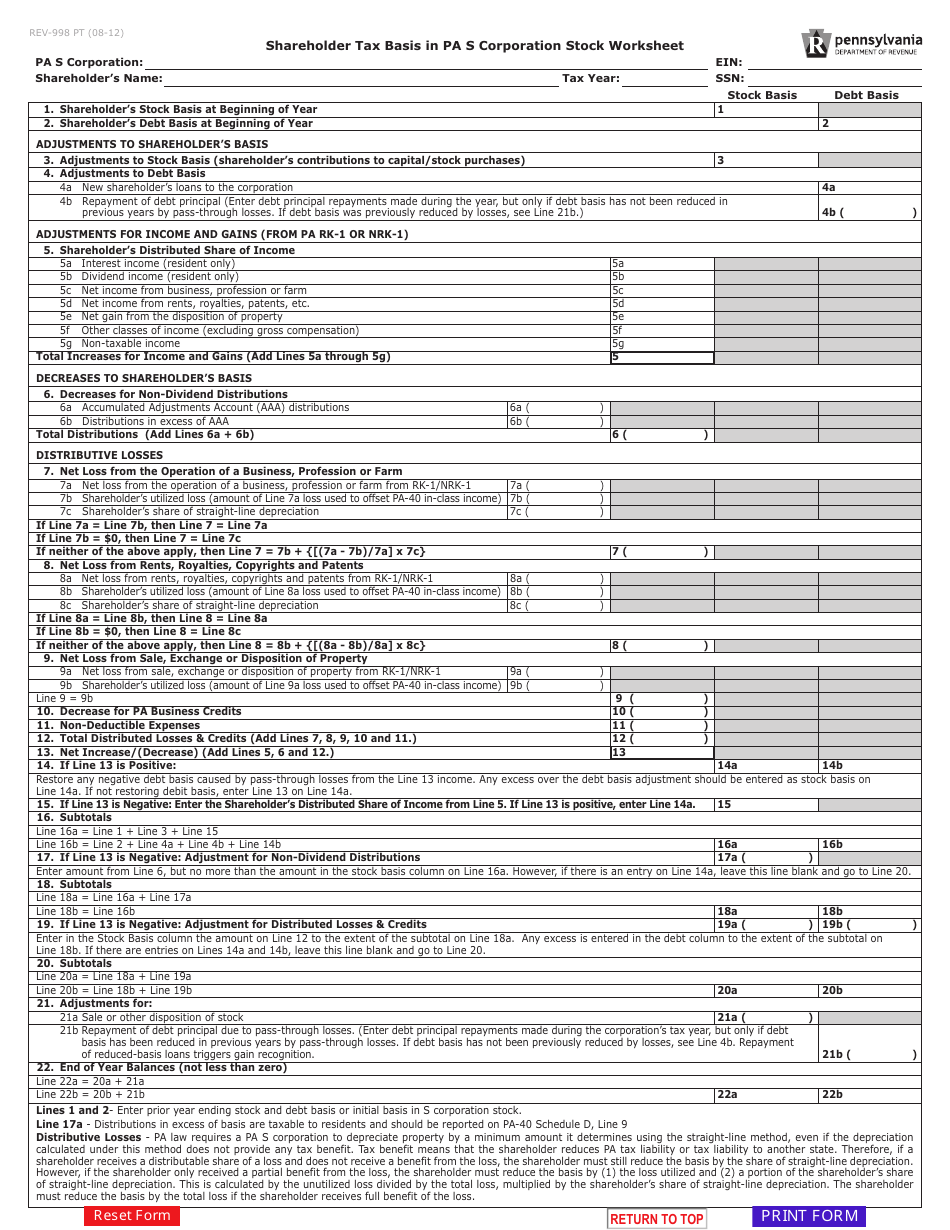

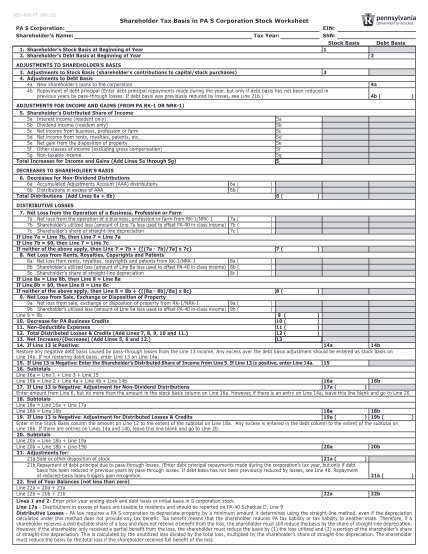

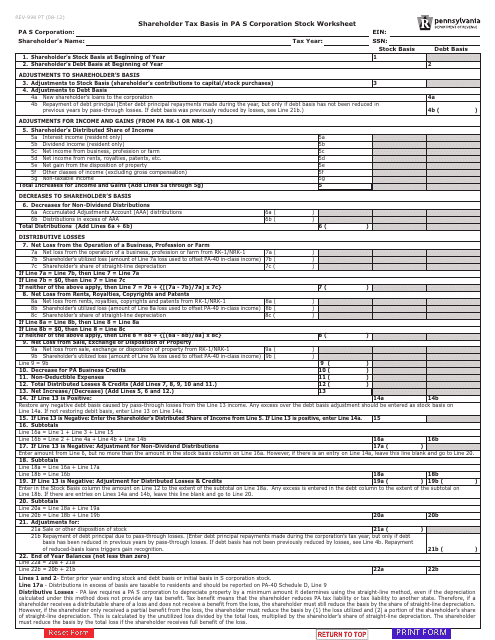

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

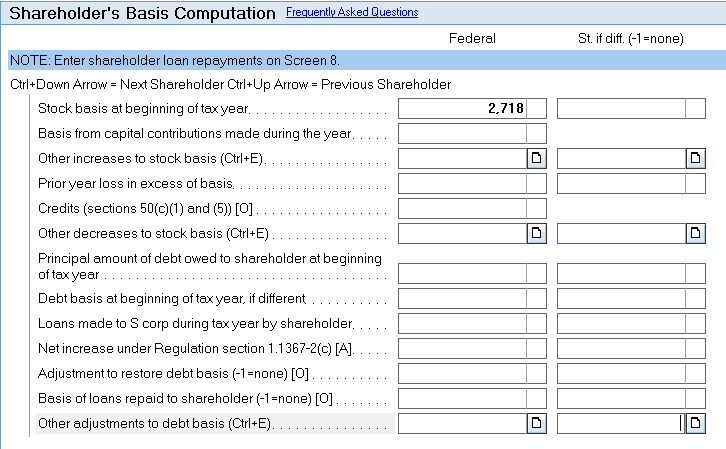

Shareholder Basis Schedule Help S Corp Module Intuit Accountants Community

Form Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Rev 998

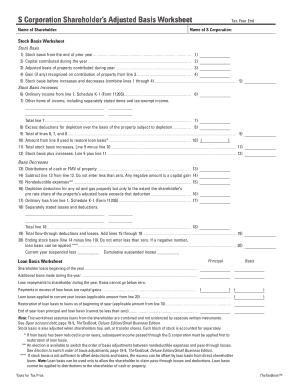

Fillable Online Client Handouts Thetaxbook Fax Email Print Pdffiller

101 Shareholders Agreement Template Two Parties Page 5 Free To Edit Download Print Cocodoc

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

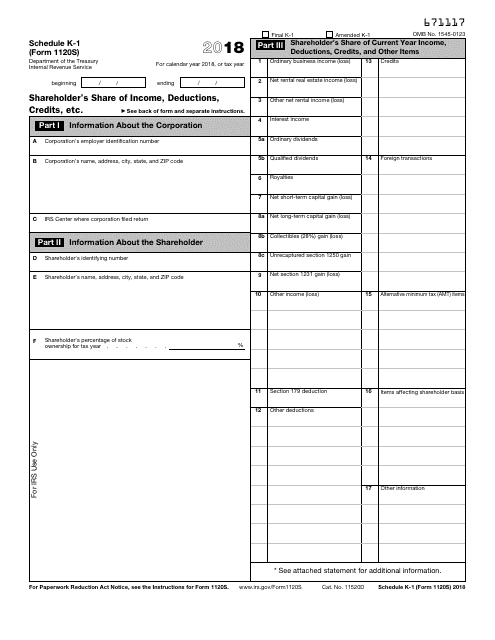

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Free Download

ConversionConversion EmoticonEmoticon